Callpay

Unlock seamless payment management with Callpay, our virtual terminal payment management application designed to empower your call centre. With Callpay, effortlessly accept and manage payments while engaging with customers. Customer accounts can be easily identified by a unique reference number providing a streamlined and secure transaction experience.

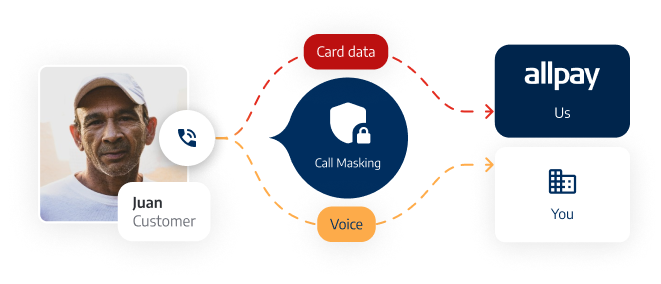

Call Masking

Ensuring PCI DSS Compliance is a top priority. Call Masking in Callpay allows customers to input their card details, displaying only the first 6 digits (BIN) and the last 4 digits of the card number and expiry date to the agent, in line with PCI DSS regulations. DTMF technology ensures secure key tones during input.

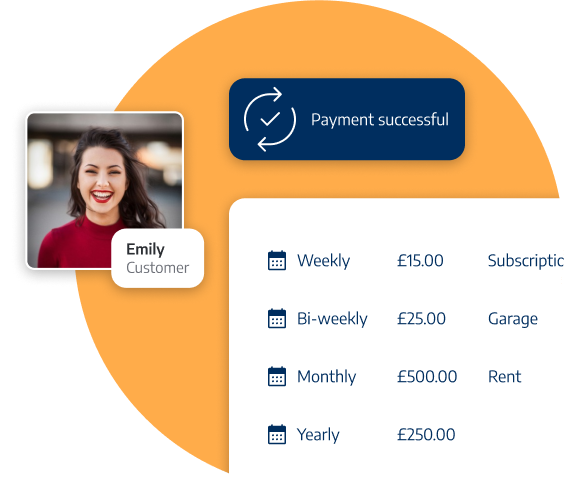

Recurring Payments

Enhance efficiency with Callpay’s recurring payment options, allowing the setup of scheduled payment plans effortlessly. Reduce customer workload and improve call centre efficiency by creating Recurring Payment schedules via our intuitive dedicated site.

Features

- Instant payments: Capture funds in real-time during customer engagements.

- Card detail protection: Ensure the security of customer card details with masked display.

- Debit card acceptance: Accept debit card payments seamlessly.

- Prevent arrears: Proactively manage payments to prevent customers from falling into arrears.

- Customer reports: Run your customer reports for insights and analytics.

- In-depth search facility: Effortlessly search and retrieve information and accounts.

Benefits

- PCI DSS Compliance: Reduce your PCI burden with a simple Self-Assessment Questionnaire and achieve PCI DSS Compliance effortlessly.

- Organisational protection: Safeguard your organisation with secure payment processes.

- Increased payment collections: Foster familiarity and trust during calls to encourage payments.

- Time and cost savings: Save time, cut costs, and improve overall operational efficiency.

Download this product sheet

Need a copy offline? Enter your email, and we’ll send you a neatly packaged copy of all the information related to this product.

I agree to be contacted with information relating to this product and for my data to be stored in line with the Privacy Statement

This works great with…

Cash Payout

Simplify payments, incentives, and refunds without the hassle of cheques or traditional transfers.

Our Payout solution streamlines the disbursement process, ensuring swift and cost-effective transactions for you and convenience for your customers.

Direct Debit

The most efficient, cost-effective, and convenient way to collect regular payments.